EFEKTIVITAS PENYELESAIAN SENGKETA FIDUSIA TERHADAP PENYERAHAN JAMINAN FIDUSIA KREDIT MIKRO

DOI:

https://doi.org/10.30997/jill.v8i1.751Abstract

Providing in a loan credit to debtor based on debt agreement, a credit can be given by anyone who have financial ability with a debt agreement between the creditor on one side and the debtor on the other side. Thus, in addition to certain binding guarantees, there must be guarantee provision which is called fiducia warrant. The characteristic of a proper object guarantee is as follows : can be executed quickly, simply in its process, efficient and contains legal certainty, so whenever a debtor default, the execution will be carried out easily without any parties suffer losses. The purpose of object guarantee is to avoid the creditor from any risk of lose concerning the credit. Based on the result of this research it can be concluded that in solving a micro credit case concerning with problematic fiducia warrant object and self protection, a bank must pay more atteintion the 5C Credit Provision. An effort for self protection, a bank may register a fiducia warrant to the fiducia warrant office as well as insure the loan to an insurance company.Downloads

Download data is not yet available.

Downloads

Published

2016-01-30

How to Cite

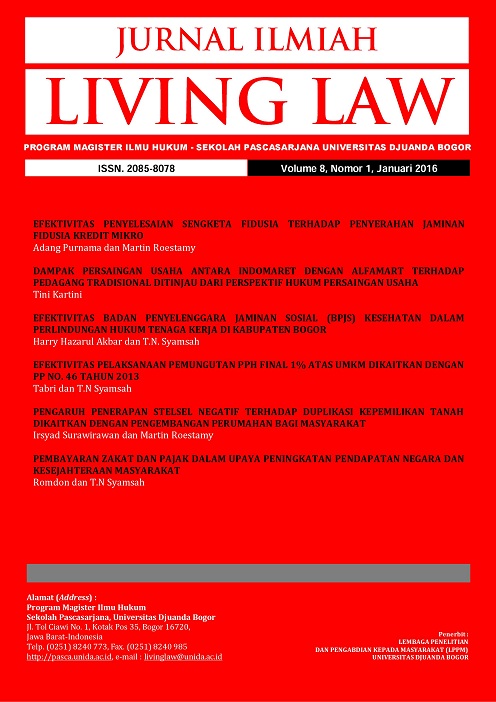

Purnama, A. (2016). EFEKTIVITAS PENYELESAIAN SENGKETA FIDUSIA TERHADAP PENYERAHAN JAMINAN FIDUSIA KREDIT MIKRO. JURNAL ILMIAH LIVING LAW, 8(1). https://doi.org/10.30997/jill.v8i1.751

Issue

Section

Articles

License

Authors who publish with Jurnal Ilmiah Living Law agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution 4.0 International License that allows others to share the work with an acknowledgement of the work's authorship and initial publication in Jurnal Ilmiah Living Law.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in Jurnal Ilmiah Living Law.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work